EMPLOYMENT (AMENDMENT) ACT 2022

|

Current Act |

Amended Act |

||

|

First Schedule Paragraph 1 |

Covered employee |

< RM2,000/ month |

< RM4,000/ month |

|

Section 18A |

Calculation of wages for incomplete month’s work |

- |

|

|

Section 37 |

Maternity leave |

60 days |

98 days |

|

Section 60FA |

Paternity leave |

- |

7 days |

|

Section 41A |

Termination of pregnant female employee |

- |

Where a female employee is pregnant or is suffering from an illness arising out of her pregnancy, it shall be an offence for her employer to terminate her services or give her notice of termination of service, except on the grounds of – (a)willful breach of a condition of the contract of service under subsection 13(2); (b)misconduct under subsection 14(1); or (c)closure of the employer’s business |

|

Section 60A |

Hours of work |

48 hours/ week |

45 hours/ week |

|

Section 60KA |

Termination of foreign employee |

- |

If the service of a foreign employee is terminated – (a)by his employer; (b)by reason of the expiry of the employment pass issued by the Immigration Department of Malaysia to the foreign employee; or (c)by reason of the repatriation or deportation of the foreign employee, the employer shall, within thirty days of the termination of service, inform the Director General of the termination in the manner as may be determined by the Director General |

|

Section 60P |

Flexible working arrangement |

- |

An employee may apply to an employer for a flexible working arrangement to vary the hours of work, days of work or place of work in relation to his employment |

| ≤ RM4,000 | >RM4,000 | ||

| Rest day | At least 1 rest day/ week | Y | Y |

| Hours of work | Not exceeding 45 hours/ week | Y | Y |

| Public holiday | (a)Minimum 11 days (b)Compulsory: (i) National day (ii) Birthday of Yang di-Pertuan Agong (iii) Birthday of the Head of State/ Federal Territory Day (iv) the Workers’ Day (v) Malaysia Day |

Y | Y |

| Annual leave | <2 years: 8 days ≥ 2 years but < 5 years: 12 days ≥ 5 years: 16 days |

Y | Y |

| Sick leave | <2 years: 14 days ≥ 2 years but < 5 years: 18 days ≥ 5 years: 22 days |

Y | Y |

| Hospitalization leave | 60 days |

Y | Y |

| Maternity leave | 98 days in each confinement •Does not have ≥ 5 surviving natural children •Has been employed by the employer - at any time in the 4 months immediately before her confinement; and - for a period of, or periods amounting in the aggregate to, ≥ 90 days during the 9 months immediately before her confinement |

Y | Y |

| Paternity leave | 7 days in each confinement •Restricted to 5 confinements irrespective of the number of spouses •Has been employed by the same employer ≥12 months immediately before the confinement of such paternity leave •He has notified his employer of the pregnancy of his spouse at least 30 days from the expected confinement or as early as possible after the birth |

Y | Y |

| Overtime (Normal day) | ((a)>5 consecutive hours without a period of leisure of ≥ 30 minutes duration (b)>8 hours/ day (c)> a spread over period of 10 hours/ day (d)>45 hours/ week 1.5 hourly rate of pay *If any day of the week <8 hours, remaining days of the week can >8 hours but ≤ 9 hours/ day and ≤ 45 hours in one week |

Y | N |

| Work on rest day | ≤ 1/2 normal hours of work: 1/2 ORP (Monthly) > 1/2 but ≤ normal hours of work: ORP (Monthly) > normal hours of work: 2 hourly rate of pay (Monthly) |

Y | N |

| Work on public holiday | Normal hours of work: 2 ORP > normal hours of work: 3 hourly rate of pay |

Y | N |

ORP= Wages/26

Hourly rate of pay = ORP/(Normal working hour)

*Overtime shall be paid not later than the last day of the next wage period

UPDATE OF SOCSO AND EIS CONTRIBUTION AMOUNT

The contribution amount that apply to employees with salaries exceeding RM4,000 per month is stated in the Third Schedule, Act 4 and the Second Schedule, Act 800.

For employees with salaries exceeding RM5,000 per month, the contribution amount is subject to the wage ceiling of RM5,000.

Accordingly, the contribution payment for the month of September 2022 and the subsequent months shall be made by the employer according to the new wage ceiling.

FORM E AND EA FORM

All Companies including dormant* companies, limited liability partnerships, trust bodies and co-operative societies are required to furnish the Form E to LHDN (Inland Revenue Board, IRB) every year not later than 31 March (31/03/2022).

Form E: To inform LHDN on the remuneration (how much salary or benefit in kinds) you paid for each employee

* Note: ‘Dormant’ with reference to the above means

(1) never commenced operations since the date it was incorporated/ established; or

(2) had previously been in operation or carried on business but has now ceased operations or business.

Refer to Section 83(1A), Income Tax Act 1967, with effect from year of assessment 2009:

Every employer shall, for each year, prepare and render to his employee statement of remuneration (EA/ EC Form) of that employee on or before the last day of February (28/02/2022) in the year immediately following the first mentioned year.

EA Form: Statement of remuneration (How much the employee was paid for previous year)

LAST CHANCE TO ENJOY TAX REBATE UP TO RM60,000

-

Tax Rebate RM20,000 each year for first three years of assessment

-

SME Digitalisation grant up to RM5,000

-

For SME who digitalize their operation, i.e.

-

Purchasing POS system

-

For setting up a company website

-

-

-

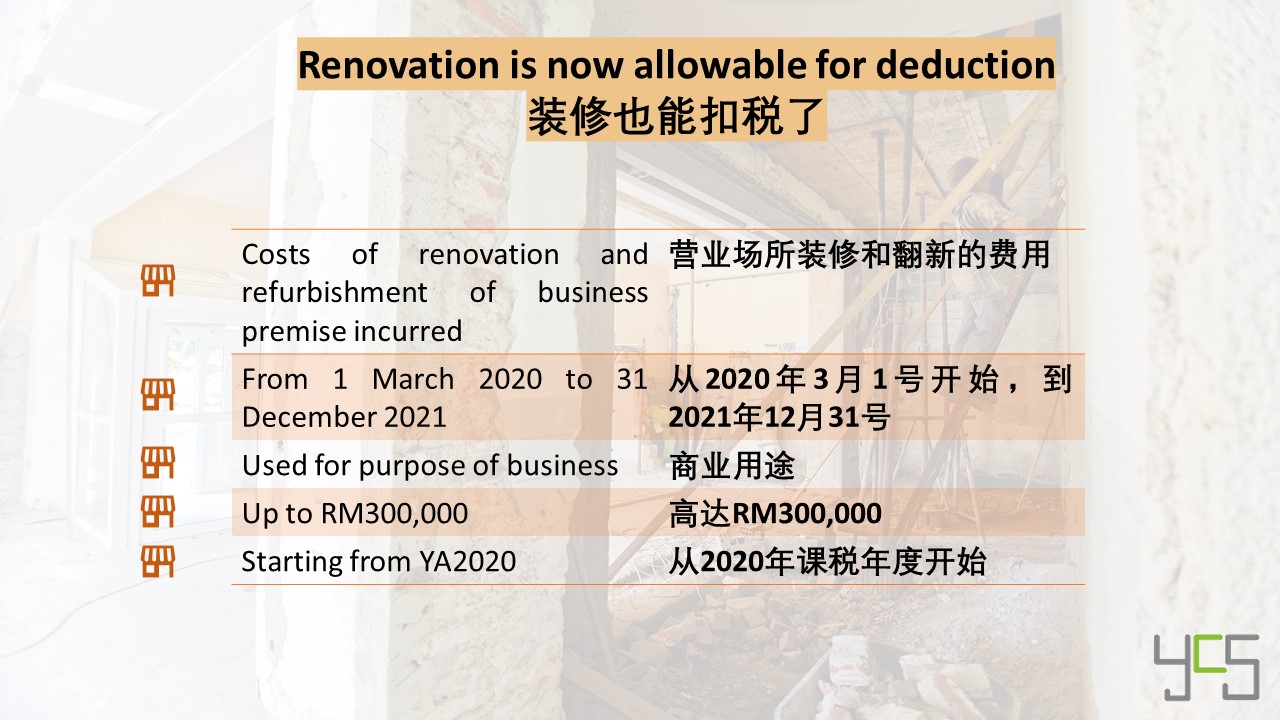

Tax reduction for cost of renovation (until 31 December 2021) up to RM300,000

-

Advantages for a SDN BHD

-

Personal wealth protection

-

The liability of its members is limited to the amount, if any, unpaid on shares held by the members only

-

A company incorporated under Companies Act 2016 is a body corporate and shall

-

Have legal personality separate from that of its members

-

-

Continuous existence

-

A company incorporated under Companies Act 2016 is a body corporate and shall continue in existence until it is removed from the register

-

The company will exist even if the key director/ shareholder passed away

-

-

Transferable ownership

-

Lower tax rate

-

Tax rate for an enterprise will be based on personal income tax rate while for a private limited company (SDN BHD) will be based on company tax rate

-

-

Higher tax saving

-

Foreigner is also allowed for set up a SDN BHD

-

-

Advantages of choosing us

-

We also have a branch located in Singapore. We can send all documents to our Singapore office for collection if the directors and shareholders are unable to come our JB office due to the lockdown between JB and SG boundary.

-

Please feel free to contact us to explore more about Advantages for Setting Up a Company Now, Benefits of a Company and Why Choosing Us to refer the list for whole activities and industries as per requested in WSP4.0 application

EXTENSION OF EMPLOYEES' EPF STATUTORY CONTRIBUTION RATE REDUCTION

Extended period: January 2022 wages (February 2022 contribution) until June 2022 wages (July 2022 contribution)

After which the minimum statutory contribution rate for employees returns to 11 per cent.

Employer and employee need to complete the KWSP17A Khas 2022 if the employee opt to maintain his/her statutory contribution rate at 11 per cent.

WAGE SUBSIDY PROGRAM (WSP) 4.0

- Malaysian

- Monthly salary NOT limited to maximum RM4,000

- Sales drop 30% in a month of year 2021 compare with any month between 2019 and 2020 (before pandemic)

- Employer and employee shall register with Perkeso before 1 June 2021

- Employer can only reduce salary or working hours upon negotiated with employee

- Employer shall notify employee in writing to inform that they are receiving WSP4.0 from Perkeso

- Shall I register again if I have applied for WSP1.0, 2.0 or 3.0

- Yes, you have to register again to get the subsidy

- If I have started operation before 1 June 2021, but I only registered with Perkeso by today, can I apply WSP4.0?

- No, you cannot

- If there is a staff resign after I get approval for WSP4.0, what can I do?

- You have to update employee list by before 15th of the month

- How if I forgot my reference number for WSP1.0, 2.0 or 3.0?

- You cannot choose you had not applied before as the system can detect it. But you can call Perkeso to obtain the reference number

FREE RTK ANTIGEN TEST KIT BY PERKESO

-

All employers who actively contribute to SOCSO

-

All employees are eligible based on the review of employee contributions in the SOCSO ASSIST Portal

- Including foreign workers

-

Free for one time only

-

The number of eligible employees will be determined based on the review of employees' active contributions in the SOCSO ASSIST Portal

- Employees who have previously undergone screening under any of SOCSO's COVID-19 Screening Program such as the Caring Screening Program (PSP) and the COVID-19 Foreign Workers Screening Program (PSPA) before are still eligible to receive test kits under this program

-

Employers need to register for this program first before a test kit application can be made

-

Registration can be made on the PSP Portal (https://psp.perkeso.gov.my)

-

Employers need to use the email address registered on the SOCSO ASSIST Portal to expedite the registration process.

-

Delivery of test kit can be made based on the locations specified by the employer

-

The employer will receive the test kit within ten days

-

Employers contact clinic to confirm the date, time and location for the screening

- The employer shall pay the cost of services to the clinic or hospital that conducts the screening

-

The screening test report will be issued to the employee

EPF QUESTIONS

- Can the monthly contributions be paid bimonthly or combined as one month?

- No, employer must pay on monthly basis

- Are salaries paid by hour subject to EPF contribution?

- Yes, if an employee works any day in a month and receives wages in excess of RM10.00 is liable to make an EPF contribution

- Is a part-time worker or employee who works with more than one employer subject to EPF contribution?

- Yes, if an employee works any day in a month and receives wages in excess of RM10.00 is liable to make an EPF contribution

- I’m above 60 years old, can I contribute EPF?

- Yes, you can submit KWSP17A to inform your employer

- Can I contribute more than 4% for my staff who are above 60 years old?

- Yes, you can submit KWSP 17 to EPF

- Can foreigner contribute EPF?

- Yes, you foreigner can register and contribute

- What should and employer do if he/she wishes to contribute more than stipulated rate for employer's share?

- An employer can make a Voluntary Excess (VE) Contribution by completing Form KWSP 17 (Maj)

- If an employee chooses to contribute more than the stipulated rate, can the employer deduct from the employee's own salary for that purpose?

- Yes, you can, but only if the employee opted for Voluntary Excess (VE) Contribution after completing Form KWSP 17A (Ahl)

NOTIFICATION BY EMPLOYER TO LHDN

- Where an employer commences to employ an individual who is or is likely to be chargeable to tax in respect of income in respect of gains or profits from the employment

- The employer shall not later than one month thereafter give written notice to the Director General

- The form (CP22) has been updated in year 2021

- Where an employer is about to cease to employ an individual who is or is likely to be chargeable to tax in respect of income in respect of gains or profits from the employment

- The employer shall not less than one month before the cessation give written notice thereof to the Director General

- The form (CP22A) has been updated in year 2021

- Where an individual chargeable to tax in respect of income in respect of gains or profits is to the knowledge of his employer about to leave or intending to leave Malaysia for a period exceeding three months

- The employer shall not less than one month before the expected date of departure give written notice of the individual's departure to the Director General

- The form (CP21) has been updated in year 2021

SALES AND SERVICE TAX (SST)

- Changing the size, shape, composition, properties or quality of the material

- Installation of tools and components into machines or equipment

- Changing the quality of finished goods

- In relation to petroleum, any process of separation, purification, conversion, refining and blending

- Accommodation

- Advertising Services

- Betting and Gaming

- Broking and Underwriting

- Clubs

- Courier Services

- Customs Agents Services

- Domestic Flight

- Electricity

Sales Tax

Threshold: RM500,000.00

Rate: 5% or 10%

Submission Cycle: Bi-monthly

* To submit not later than the last day of the following month after the taxable period ended regardless there is any tax to be paid or not

Sales Tax: Accrual Basis

Service Tax: Payment Basis

*Contra system: Can deduct service tax for any cancellation and termination of services or any other reasons such as reducing premiums or discounts

- Employment Services

- Food & Beverages

- Hire Passenger Vehicles Services

- Information Technology Services

- Motor Vehicle Services or Repair Centre

- Paid Television Broadcasting Services

- Parking Services

- Professional Services

- Telecommunication Services

Service Tax

Threshold: RM500,000.00

*except Restaurant RM1,500,000.00 and Credit Card or Charge Card and Custom Agent no threshold

Rate: 6%, A specific rate of tax of RM 25 is imposed upon issuance of principal or supplementary card and every subsequent year or part thereof

Submission Cycle: Bi-monthly

* To submit not later than the last day of the following month after the taxable period ended regardless there is any tax to be paid or not

The recovery of cost or a payment made by registered person on behalf of another party is termed as a “disbursement” and is NOT subject to Service Tax

A reimbursement is subject to Service Tax

WITHHOLDING TAX

- Contract Payment

- Interest

- Royalty

- Special classes of income: Technical fees, payment for services, rent/payment for use of moveable property

- Interest (except exampt interest) paid by approved financial institutions

- Income of non-resident public entertainers

- Real Estate Investment Trust (REIT)

(i) Other than a resident company

(ii) Non Resident company.

(iii) Foreign investment institution

effective from 01/01/2007 - Family Fund/Takaful Family Fund/Dana Am

(i) Individual and other

(ii) Non Resident Company - Income under Section 4(f) ITA 1967

ADVANTAGES OF SETTING UP A COMPANY NOW

-

Tax Rebate RM20,000 each year for first three years of assessment

-

Technology solutions partner (TSP) grant up to RM5,000

-

For purchasing POS system

-

For setting up a company website

-

-

Tax reduction for cost of renovation (until 31 December 2021) up to RM300,000

-

Advantages for a SDN BHD

-

Personal wealth protection

-

The liability of its members is limited to the amount, if any, unpaid on shares held by the members only

-

A company incorporated under Companies Act 2016 is a body corporate and shall

-

Have legal personality separate from that of its members

-

-

Continuous existence

-

A company incorporated under Companies Act 2016 is a body corporate and shall continue in existence until it is removed from the register

-

The company will exist even if the key director/ shareholder passed away

-

-

Transferable ownership

-

Lower tax rate

-

Tax rate for an enterprise will be based on personal income tax rate while for a private limited company (SDN BHD) will be based on company tax rate

-

-

Higher tax saving

-

Foreigner is also allowed for set up a SDN BHD

-

-

Advantages of choosing us

-

We also have a branch located in Singapore. We can send all documents to our Singapore office for collection if the directors and shareholders are unable to come our JB office due to the lockdown between JB and SG boundary.

-

Please feel free to contact us to explore more about Advantages for Setting Up a Company Now, Benefits of a Company and Why Choosing Us

ADVANTAGES OF A SDN BHD (PRIVATE LIMITED COMPANY)

Advantages of a SDN BHD

- Personal wealth protection

- Continuous existence

- Transferable ownership

- Lower tax rate

- Higher tax saving

- Foreigner is also allowed to set up a SDN BHD

- Personal Wealth Protection

- The liability of its members is limited to the amount, if any, unpaid on shares held by the members only

- A company incorporated under Companies Act 2016 is a body corporate and shall

- Have legal personality separate from that of its members

- Continuous Existence

- A company incorporated under Companies Act 2016 is a body corporate and shall continue in existence until it is removed from the register

- The company will exist even if the key director/ shareholder passed away

- Tax Rate

- Tax rate for an enterprise will be based on personal income tax rate while for a private limited company (SDN BHD) will be based on company tax rate

- Shareholder can declare dividend while director can receive director’s fees or director’s remuneration

- For a SDN BHD, shareholder can take out profits from the company (provided that the company is solvent)

- Director can also receive salary from the company

- All these will be seem as drawing for an enterprise

TAX REBATE

Beneficiary: SMEs Incorporated within 1 July 2020 to 31 December 2021

Conditions

- SMEs registered under the Companies Act 2016;

- Paid-up capital of RM2.5 million and below with annual sales not exceeding RM50 million per annum;

- The amount of rebates is the capital expenditure or operating expenses incurred in each year of assessment subject to a maximum value of RM20,000 per year of assessment;

- Unused tax rebates cannot be carried forward to the next year of assessment for tax deduction purposes;

- This new entity must use separate plants, equipment and facilities and not transfer from existing or related companies; and

- Other conditions will be set

TAX DEDUCTION FOR RENOVATION COST

A deduction shall be allowed for the costs of renovation and refurbishment of business premise incurred by the person from 1 March 2020 until 31 December 2021 and used for the purpose of its business

-

General electrical installation

-

Lighting

-

Gas system

-

Water system

-

Kitchen fittings

-

Sanitary fittings

-

Door, gate, window, grill and roller shutter

-

Fixed partitions

-

Flooring (including carpets)

-

Wall covering (including paint work)

-

False ceiling and cornices

-

Ornamental features or decorations excluding fine art

-

Canopy or awning

-

Fitting room or changing room

-

Recreational room for employee

-

Air-conditioning system

-

Children play area

-

Reception area

-

Surau

SME DIGITALISATION INITIATIVE

- Features

- Grant amounting up to 50% or a maximum of RM 5,000 from total invoice amount.

- Great deals on digital solutions from a wide list of panels endorsed by MDEC.

- Wide range of digitalization areas:-

- Electronic Point of Sales (e-POS) System

- Human Resource Payroll System (HR) / Customer Relationship Management (CRM)

- Digital Marketing / Sales

- Procurement

- Enterprise Resource Planning (ERP) / Accounting & Tax

- eCommerce

- Remote working

- Required Documents

- Completed SME Digitalisation Initiative Application Form

- Copy of Identity Card or Passport of Director (s) / Partner (s) / Proprietor(s), whichever is applicable.

- Copy of business registration licenses (CCM, Form A/B, Form 24 & 49 and M&A or any similar forms under the Companies Act 2016).

- Audited financial statement for the last financial year and the latest management account or evidende of sales turnover (if any).

- Company’s bank statement for the last two (2) months.

- Company’s profile (if any).

- Invoice/billing and service agreement from authorized vendor listed by MDEC

- Eligibility

- The Company is at least 60% owned by Malaysians

- The Company is registered under the relevant laws of Malaysia

- The Company has been in operation for at least one (1) year

- Company operation in one ( 1 ) year, company required to have a minimum annual sales turnover of RM 100,000

- Company operation > two (2) years, company required to have a minimum annual sales turnover of RM 50,000 (preceding two (2) consecutive years)

- The Company is at least 60% owned by Malaysians

- How to Apply

- The Company must contact and appoint one or more panel of Service Providers to perform any of the digitalisation services available (maximum of 3 panels).

- The Company must complete and submit the application form together with the required supporting documents to any of the Bank's branches.

- Once the application is approved, the Company is responsible to pay the difference of the total invoice after deducting the subsidized amount granted from the Initiative and to provide proof of payment to any of the Bank’s branches.

- After proof of payment is provided, subject to the total invoice amount, the Bank will make a direct 50% payment of the total invoice amount or up to RM 5,000.00 to the Service Provider in one lump sum payment or in stages based on the Bank’s discretion

TRANSFER PRICING

Transfer pricing generally refers to intercompany pricing arrangements for the transfer of goods, services and intangibles between associated persons

According to Para 4 (1) of the Income Tax (Transfer Pricing) Rules 2012 within the Income Tax Act 1967, ‘A person who enters into a controlled transaction shall prepare a contemporaneous transfer pricing documentation.’

In Section 139 of the Income Tax Act (ITA), control refers to both direct and indirect control. Under the Guidelines, two companies are associated companies with respect to each other if one of the companies participates directly or indirectly in the management, control or capital of the other company; or the same persons participate directly or indirectly in the management, control or capital of both companies.

However, the Malaysian TP Guidelines 2012 further provide additional leeway for smaller tax payers to ease their compliance burden as follow:

Malaysian companies are required to prepare a full-fledged transfer pricing documentation if they have:

- Gross income exceeding RM25 million; and

- The total amount of related party transactions exceeding RM15 million or

- Provision of financial assistance exceeding RM50 million (not applicable for financial institutions)

Any person which falls outside the above scope may opt to fully apply all relevant guidance as well as fulfill all Transfer Pricing Documentation requirements in the Guidelines; or alternatively may opt to comply with Transfer Pricing Documentation requirements under paragraph 25.4(a), (d) and (e) only. In this regard, the person is allowed to apply any method other than the five methods described in the Guidelines provided it results in, or best approximates, arm’s length outcomes.

a. Organizational Structure

- The taxpayer's worldwide organizational and ownership structure (including global organization chart and significant changes in the relationship, if any), covering all associated persons whose transactions directly or indirectly affect the pricing of the documented transactions; and

- A description of the management structure of the local entity, a local organization chart, and a description of the individuals to whom local management reports and the country(ies) in which such individuals maintain their principal offices

d. Pricing Policies

- The formula adopted, including anticipated profit margin/mark-up and cost component

- How the formula is applied

- Who determine the pricing policy

- How often is the policy being revised

- Sample of documents to support the pricing policy

- Comparability study to ensure the arm's length price

e. Assumption, Strategies and Information regarding Factors that Influence the Setting of Pricing Policies

- Relevant information regarding business strategies and special circumstances at issue, for example, intentional set-off transactions, market share strategies, distribution channel selection and management strategies that influenced the determination of transfer prices

- Assumptions and information regarding factors that influenced the setting of prices or the establishment of any pricing policies for the taxpayer and the related party group as a whole

- Documentation to support material factors that could affect prices or profits in arm's length dealings

PERSONAL INCOME TAX

Form BE

- Stay AT LEAST 182 days in Malaysia in a year (regardless of citizenship or nationality)

- NOT carry on business

- Submission due date: 30 April

- Stay LESS than 182 days in Malaysia in a year (regardless of citizenship or nationality)

- NO MATTER WHETHER carry on business

- Submission due date: 30 April (not on business) or 30 June (carry on business)

-

Stay AT LEAST 182 days in Malaysia in a year (regardless of citizenship or nationality)

-

CARRY on business in Malaysia

-

Submission due date: 30 June

- Director salary is type of employment income

- If the director stay less than 182 days in Malaysia, he/she shall submit Form M

- If the director stay at least 182 days and DO NOT carry on business in Malaysia, he/she shall submit Form BE by before 30 April

- If the director stay at least 182 days and CARRY ON business in Malaysia, he/she shall submit Form B by before 30 June

- Rental income can be BUSINESS income or NON-BUSINESS income

- Letting of real property is deemed as a business source if maintenance or support services are provided in relation to the real property

- Income derived from e-commerce is a business income. If the business is not registered as a SDN BHD or LLP, the owner shall submit the Form B or Form M by before 30 June

- Individual

- Individual and dependent relatives RM 9,000.00

- Education fees (Self) RM 7,000.00 (Restricted)

- Lifestyle – Expenses for the use / benefit of self, spouse or child in respect of: RM 2,500.00 (Restricted)

- Purchase of books / journals / magazines / printed newspapers / other similar publications (Not banned reading materials)

- Purchase of personal computer, smartphone or tablet (Not for business use)

- Purchase of sports equipment for sports activity defined under the Sports Development Act 1997 and payment of gym membership

- Payment of monthly bill for internet subscription (Under own name)

- Lifestyle – Purchase of personal computer, smartphone or tablet for self, spouse or child and not for business use RM 2,500.00 (Restricted)

- (Additional deduction for purchase made within the period of 1st June 2020 to 31st December 2020)

- Life insurance and EPF INCLUDING not through salary deduction RM 7,000.00 (Restricted)

- Education and medical insurance INCLUDING not through salary deduction RM 3,000.00 (Restricted)

- Contribution to the Social Security Organization (SOCSO) RM 250.00 (Restricted)

- Disabled individual RM 6,000.00

- Family

- Medical treatment, special needs and carer expenses for parents (Medical condition certified by medical practitioner) RM 5,000.00 (Restricted)

- OR

- Restricted to 1,500 for only one mother

- Restricted to 1,500 for only one father

- OR

- Basic supporting equipment for disable self, spouse, child or parent RM 6,000.00 (Restricted)

- Medical expenses for serious diseases for self, spouse or child RM 6,000.00 (Restricted)

- Complete medical examination for self, spouse, child RM 500.00 (Restricted)

- Husband / wife / payment of alimony to former wife RM 1,000.00 (Restricted)

- Child care fees to a registered child care centre / kindergarten for a child aged 6 years and below RM 3,00.00 (Restricted)

- Purchase of breastfeeding equipment for own use for a child aged 2 years and below (Deduction allowed once in every 2 years of assessment) RM 4,000.00 (Restricted)

- Disabled husband / wife RM 3,500.00

- Disabled child RM 6,000.00

- Additional exemption of RM8,000 disable child age 18 years old and above, not married and pursuing diplomas or above qualification in Malaysia @ bachelor degree or above outside Malaysia in program and in Higher Education Institute that is accredited by related Government authorities

- Medical treatment, special needs and carer expenses for parents (Medical condition certified by medical practitioner) RM 5,000.00 (Restricted)

- Children

- Each unmarried child and under the age of 18 years old RM 2,000.00

- Each unmarried child of 18 years and above who is receiving full-time education ("A-Level", certificate, matriculation or preparatory courses) RM 2,000.00

- Each unmarried child of 18 years and above that: RM 8,000.00

- Receiving further education in Malaysia in respect of an award of diploma or higher (excluding matriculation/ preparatory courses)

- Receiving further education outside Malaysia in respect of an award of degree or its equivalent (including Master or Doctorate).

- The instruction and educational establishment shall be approved by the relevant government authority

- Individual - Special for YA2020

- Domestic travel expenses - (Accommodation expenses at premises registered with the Ministry of Tourism, Arts and Culture Malaysia and entrance fees to tourists attractions incurred on or after 1st March 2020) RM1,000.00 (Restricted)

- Deferred Annuity and Private Retirement Scheme (PRS) - with effect from year assessment 2012 until year assessment 2021 RM3,000.00 (Restricted)

EMPLOYER OBLIGATIONS

Employee Provident Fund (EPF)

According to Section 41 (1) of the EPF Act 1991, an employer must register with the EPF within seven (7) days from the date the employer becomes liable to contribute, that is as soon as an employee is hired

- An employer is defined as a person with whom an employee has a contract of service or apprenticeship with

- An employee is defined as a person who is employed under a contract of service or apprenticeship. The contract of service or apprenticeship can be written or oral, expressed or implied

Minimum age: Employment age is subject to Children and Young Persons (Employment) Act 1966.

Maximum Age: 75 years

Contribution for any given month must be paid on or before the 15th of the month

Contribution rate shall be 11% from employee and 12% / 13% from employer

* Malaysian below 60 years old)

Payment Liable for EPF Contribution

In general, all payments which are meant to be wages are accountable in your monthly contribution amount calculation. These include:

- Salary

- Payment for unutilised annual or medical leave

- Bonus

- Allowance

- Commission

- Incentive

- Arrears of wages

- Wages for maternity leave

- Wages for study leave

- Wages for half day leave

- Other payments under services contract or otherwise

Social Security Organisation (SOCSO)

Employer and its employees must be registered with SOCSO not later than 30 days on which the Act becomes applicable to the industry

Employers are required to pay monthly contributions for each eligible employee according to the rate specified under the Employees’ Social Security Act, 1969. These contributions are divided into two (2) types, namely:

Contributions of the First Category

- For employees who are less than 60 years of age, contributions payable by employers and employees are for the Employment Injury Scheme and the Invalidity Scheme.

- The rate of contribution under this category comprises 1.75% of employer’s share and 0.5% of employees’ monthly wages according to the contribution schedule.

Note: All employees who have not reached the age of 60, must contribute under the First Category except for those who have attained 55 years of age and have no prior contributions before they reach 55 due to non-eligibility under the Employees’ Social Security Act, 1969.

Contributions of the Second Category

- The rate of contribution under this category is 1.25% of employees’ monthly wages, payable by the employer, based on the contribution schedule. All employees who have reached the age of 60 must be covered under this category for the Employment Injury Scheme only.

Note: For eligible new employees who are 55 years of age, they must be covered under the Second Category.

* Contribution rates are capped at an assumed monthly salary of RM4,000.00

Contribution for any given month must be paid on or before the 15th following of the salary month

Wages subject to SOCSO contribution:

All remuneration or wages stated below and payable to staff/ workers are subject to SOCSO contributions:

- Salary/ Wages (Full/ Part time, Monthly/ Hourly)

- Overtime payments

- Commission

- Paid leave (Annual, sick and maternity leave, rest day, public holidays)

- Allowances

- Service charge

Wages NOT subject to SOCSO contribution:

The following wages or remuneration payable to staff/ workers are NOT subject to SOCSO contributions:

- Payments by employer to any pension or provident fund for employees

- Mileage claims

- Gratuity payment(s) for dismissal or retrenchments

- Annual bonus

Employment Insurance Scheme (EIS)

Employer and its employees must be registered with SOCSO not later than 30 days on which the Act becomes applicable to the industry

All employers in the private sector are required to pay monthly contributions on behalf of each employee. (Government employees, domestic workers and the self-employed are exempt)

An employee is defined as a person who is employed for wages under a contract of service or apprenticeship with an employer. The contract of service or apprenticeship may be expressed or implied and may be oral or in writing.

All employees aged 18 to 60 are required to contribute. However, employees aged 57 and above who have no prior contributions before the age of 57 are exempt.

* Contribution rates are capped at an assumed monthly salary of RM4,000.00

Contribution for any given month must be paid on or before the 15th following of the salary month

Contribution rate shall be 0.2% from both employee and employer

Wages subject to EIS contribution:

All remuneration or wages stated below and payable to staff/ workers are subject to EIS contributions:

- Salary/ Wages (Full/ Part time, Monthly/ Hourly)

- Overtime payments

Wages NOT subject to EIS contribution:

The following wages or remuneration payable to staff/ workers are NOT subject to EIS contributions:

- Payments by employer to any pension or provident fund for employees

- Mileage claims

- Gratuity payment(s) for dismissal or retrenchments

- Annual bonus

Potongan Cukai Bulanan (PCB)

Also known as Monthly Tax Deduction (MTD) which is a system of tax recovery where employers make deductions from their employees’ remuneration every month in accordance with the MTD Schedule. This is mandatory.

Employer can register and calculate at any time before payment of salaries to employees and pay to LHDN within 15 days of the following month

Employer's responsibilities under the MTD Rules are as follows:

- Deduct the MTD from the remuneration of employee in each month or the relevant month in accordance with the Schedule of Monthly Tax Deductions or Computerised Calculation Method and pay to the Director General.

- Make additional deductions from employee's remuneration in accordance with the direction given by the Director General under Rule 4 of MTD Rules.

- Employer shall pay to the Director General, not later than the fifteen day of every calendar month, the total amount of tax deducted or should have been deducted by him from the remuneration of employees during the preceding calendar month.

- Furnish a complete and accurate employees' information of the following in a return when submitting MTD payments/additional deductions:

(i) income tax number (if any);

(ii) name as stated on identity card or passport;

(iii) new and old identity card number/police number/army number or passport number (for foreign employee); and

(iv) MTD/additional deductions amount.

Human Resource Development Fund (HRDF)

- Malaysia Human Resources Development Fund (HRDF) has expanded the coverage of the PSMB Act 2001 with effect from 1 March 2021

- Who are eligible under the expansion of the Act?

- Malaysian employers across all sectors

- With a minimum of ten (10) local employees

- HRDF is the levy collected by way of legal authority on eligible employers in Malaysia which is used for training, developing and upgrading the skills of their local employees, apprentices and trainees through training grants

- The payment of the HRDF levy is the responsibility of employers which they are not permitted to deduct the wages of employees under any circumstances for the payment of the levy

- Similar with EPF, all payment of the levy shall be made by the employer not later than the fifteenth day of the month immediately following the month in respect of which those payments fall due

- Form 1 is avaible for online submission HERE

Form E

Form E (Borang E) is required to be submitted by every employer (company/enterprise/partnership) to LHDN (Inland Revenue Board, IRB) every year not later than 31 March.

Who Needs to File Form E?

All companies. LHDN: “Every employer shall, for each year, furnish to the Director General a return in the prescribed form…”

Due Date for Submission of Form E

- Subsection 83(1) of ITA 1967 stipulates that the form must be furnished by every employer before or on 31 March. Form E will only be considered complete if C.P. 8D is furnished before or on the due date for submission of the form.

Grace Period for Submission of Form E for The Year of Remuneration

|

Form |

Method of Submission |

Grace Period |

|

e-E |

e-Filing * |

Until 30 April |

|

E |

Via postal delivery |

3 working days |

|

By hand-delivery |

None |

* Employers which are companies are compulsorily required to furnish Form E via e-Filing (Form e-E) with effect from the Year of Remuneration 2016.

- Form E furnished via e-Filing / postal delivery after the due date for its submission shall be deemed to be received within the stipulated period if it is received before or on 30 April (e-Filing) / within 3 working days (postal delivery).

- Failure to furnish within the allowable period will result in the imposition of compound under paragraph 120(1)(b) of the Income Tax Act 1967 (ITA 1967) based on the due date for submission of the form.

Form C.P. 8A / C.P. 8C (EA / EC) to be Rendered to Employees

- Pursuant to the provision under subsection 83(1A) of ITA 1967, employers are required to prepare Form C.P. 8A / C.P. 8C (EA / EC) for the year ended and render the completed form to all their employees before or on 28 February.

FORM E will only be Considered complete if C.P.8D is Furnished

C.P. 8D Format – Method of Submission by Employers for The Year of Remuneration

Employers are required to furnish C.P. 8D format to LHDNM via any of the methods stated below:

|

No. |

Employer |

Approved Method of C.P. 8D Submission

|

|

|

C.P. 8D – Pin. 2016 (Current Version) |

C.P. 8D – Pin. 2015 (Old Version) |

||

|

i. |

Companies (Including Labuan Companies) |

a) Together with Form e-E (e-Filing) b) Via e-Data Praisi c) Compact Disc |

a) Together with Form e-E (e-Filing) b) Compact Disc |

|

ii. |

Non-Companies |

a) Together with Form e-E (e-Filing) b) Together with Paper Form E c) Via e-Data Praisi d) Compact Disc |

|

|

Note: |

Employers who have submitted information via e-Data Praisi need not complete and furnish Form C.P. 8D. |

||

DORMANT Companies must file FORM E

Companies which are dormant and/or have not commenced business are required to furnish the Form E with effect from year of assessment 2014.

E-Filing System Opens on 1 March

The e-Filing system for submission of Form E for the year of Remuneration will be opened beginning 1 March.

Penalties up to RM20,000 or 6 Months Imprisonment

Please be advised that it is the employer’s responsibility to complete the form E and return it promptly to the Inland Revenue Board.

Penalties ranging from RM200 to RM20,000 or to imprisonment for a term not exceeding 6 months or both will be imposed if you fail to comply with the stipulated filing date.

Prefill of Remuneration Particulars In e-Filing

To facilitate taxpayers’ use of e-Filing in line with current technological development, LHDNM is further reinforcing its e-Filing system by obtaining remuneration particulars of taxpayers from their employers for prefill in their respective e-Filing forms. Prior to signing and sending the forms electronically, taxpayers using e-Filing may alter the prefilled particulars if there’s a change.

Employers are encouraged to furnish the particulars online using e-Data Praisi which can be accessed via the LHDNM Official Portal before or on 22 February. The format for Information_Layout for Prefill can be obtained from the LHDNM Official Portal. To ensure compliance with the required format, format check can be done via e-Data Praisi. Particulars furnished are acceptable as C.P. 8D particulars for Form E. Employers who have submitted information via e-Data Praisi need not complete and furnish Form C.P. 8D. Enquiries can be e-mailed to bantuan_praisi@hasil.gov.my.

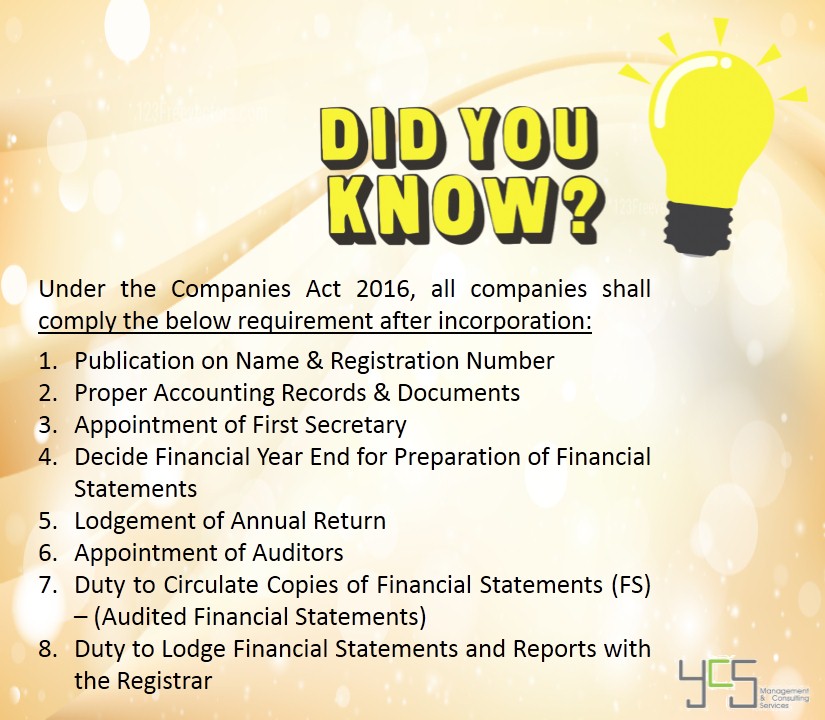

OBLIGATIONS UNDER COMPANIES ACT 2016

1. Publication on Name & Registration Number (Immediately)

For existing and newly incorporated companies, all Business Letters, Statements of Account, Invoices, Official Notices, Official Publications, Websites, Bills of Exchange, Promissory Notes, Endorsements, Cheques, Order Forms, Invoices, Receipts and Letters of Credit or of Purporting is to be issued or signed by or on behalf of, the company, and all other forms of its business correspondences and documentation should have the Company Name (regardless if the business is operating under a business name) and Company Registration Number.

2. Proper Accounting Records & Documents (Immediately)

Keeping proper accounting and other records in hard copy which sufficiently explain the transactions and financial position of the company to present true and fair profit and loss accounts and balance sheets for 7 years.

3. Appointment of First Secretary (Within 30 days from date of incorporation)

Every SDN. BHD. MUST appoint at least one Company Secretary. The licensed secretary appointed by the Board of Directors of a limited company will look after and conduct all legal and procedural matters as required by the Companies Act 2016 and all other applicable laws fall under the duties of a Company Secretary.

4. Decide Financial Year End for Preparation of Financial Statements (Within 18 months from date of incorporation)

For newly incorporated companies, the Directors of the company should decide the company’s financial year end which should be not later than 18 months from the date of incorporation. Financial statements must be prepared.

5. Lodgement of Annual Return (Within 30 days from the anniversary of the incorporation date)

The Lodging of Annual Return for each calendar year should be done not later than 30 days from the anniversary of the incorporation date. The annual return will be prepared by the Company Secretary and signed by the director.

6. Appointment of Auditors (30 days before the end of the period for lodgement of financial stateme)

Every SDN. BHD. should appoint an auditor for each financial year for the company before 30 days from

- For newly incorporated company

- Before the end of the period for the submission of the first financial statement to the Registrar

- For subsequent years

- Before the end of the period allowed for the lodgement of the previous year financial statement

- If the previous year FS was lodged earlier, before the day on which financial statements were lodged

7. Duty to Circulate Copies of Financial Statements (Within 6 months from the financial year end of the private company)

Every company should send a copy of FS for each financial year to

- Every member of the company

- Every person entitled to receive general meeting notices

- Every auditors of the company

- Every debenture holder of the company on request being made, to the last known address provided to the company

8. Duty to Lodge Financial Statements and Reports with the Registrar (Within 30 days from the date of circulation of financial statements and reports)

The financial statements and reports have to be lodged with the SSM within 30 days from the date the financial statements and reports are circulated to its members.

We do provide the professional accounting services and secretarial services to make sure your company is comply with the Companies Act 2016. Kindly refer to the details of our Malaysia services at OUR SERVICES. Please feel free to contact us at +607-2254911 should you need any further clarification. Or you can just click HERE to contact us directly.

For more information, you may refer to http://www.ssm.com.my/Pages/Home.aspx

MCO3.0 JOHOR - JOHOR BAHRU, KULAI, KOTA TINGGI

- The government agreed to allow all sectors of the economy including the manufacturing sector to continue operating during MCO3.0 (except SPA surgery and reflexology)

- Entertainment activities (including pub, theme park, indoor playground, family karaoke and cinemas) are not allowed

- Only 30% of management staffs are allowed to work in the office

- ALL (100%) of non-management staffs are allowed to work in the office

- Management staff: Based on the employment contract (means employer shall decide which staffs are considered as management staff of the company)

- MITI approval letter (Please refer to our Facebook page for the guide to get the letter)

- Employer authorized letter

HRDF EXPANSION

- Malaysia Human Resources Development Fund (HRDF) has expanded the coverage of the PSMB Act 2001 with effect from 1 March 2021

- Who are eligible under the expansion of the Act?

- Malaysian employers across all sectors

- With a minimum of ten (10) local employees

- HRDF is the levy collected by way of legal authority on eligible employers in Malaysia which is used for training, developing and upgrading the skills of their local employees, apprentices and trainees through training grants

- The payment of the HRDF levy is the responsibility of employers which they are not permitted to deduct the wages of employees under any circumstances for the payment of the levy

- Similar with EPF, all payment of the levy shall be made by the employer not later than the fifteenth day of the month immediately following the month in respect of which those payments fall due

- Form 1 is avaible for online submission HERE

There are some employer obligations you might be missed out:

- Every employer in Malaysia have to contribution EPF, SOCSO, EIS and PCB

- Part-time workers are also subjected to payroll contributions

- The contribution rate are be different between different category (for example for employees above 60 years old)

- Not every remuneration subject to payroll contributions

SME CERTIFICATE

|

Manufacturing |

|

Services and Others |

|

Sales turnover: RM15M ≤ RM50M OR Employees: From 75 to ≤ 200 |

Medium |

Sales turnover: RM3M ≤ RM20M OR Employees: From 30 to ≤ 75 |

|

Sales turnover: RM300,000 < RM15M OR Employees: From 5 to < 75 |

Small |

Sales turnover: RM300,000 < RM3M OR Employees: From 5 to < 30 |

|

Sales turnover: < RM300,000 OR Employees: <5 |

Micro |

Sales turnover: < RM300,000 OR Employees: <5 |

-

Full time employees: Including all paid workers working for at least 6 hours a day and 20 days a month; or at least 120 hours a month (including foreign and contract workers)

-

The word ‘OR’ means a business will only need to satisfy either one of the criteria: sales turnover or number of employees

-

If a business exceeds the threshold for 2 consecutive years (base on financial year) then it is no longer an SME

-

Similarly, a business that is previously large can become an SME if it fulfils the qualifying criteria for 2 consecutive years

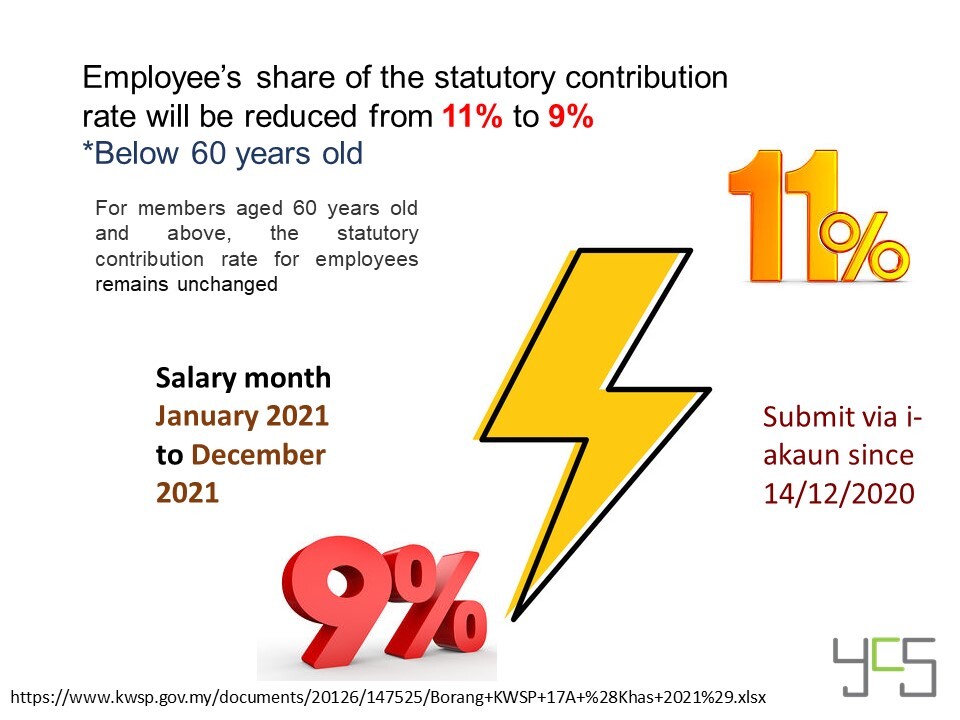

EPF CONTRIBUTION RATE REDUCE FROM 11% TO 9% FOR YEAR 2021

This new statutory contribution rate for employees applies only to members below 60 years old who are liable for contribution. For members aged 60 years old and above, the statutory contribution rate for employees remains unchanged.

** The KWSP 17A Khas 2021 can be downloaded from https://www.kwsp.gov.my/documents/20126/147525/Borang+KWSP+17A+%28Khas+2021%29.xlsx

MALAYSIA BUDGET 2021

- Bantuan Prihatin Rakyat (BPR)

- Monthly Household Income 家庭月收入 ≤RM2,500 - RM1,200 for 1 child, RM1,800 for more than 1 children

- Monthly Household Income 家庭月收入 RM2,501 to RM4,000 - RM800 for 1 child, RM1,200 for more than 1 children

- Monthly Household Income 家庭月收入 RM4,001 to RM5,000 - RM500 for 1 child, RM750 for more than 1 children

- Single (≥21 years old) ≤RM2,500 - RM350

- Reduce 1% income tax rate (to become 13%) for chargeable income between RM50,001 to RM70,000 降低RM50,001至RM70,000应课税收入1%个人所得税率(至13%)

- Reduce EPF contribution rate employee portion from 11% to 9% 降低雇员部分的公积金率至9%

- Withdraw RM500 from account 1 from Jan'21 for a period of 12 months 从公积金第一户口每个月提取RM500,为期12个月

- Withdraw from account 2 to purchase insurance and takaful products 从公积金第二户口提取以购买保险

- Lifestyle tax relief expand to electronic newspaper subscription and additional RM500 for expenditure related to sports (including participating fee for sports competitions)

- Extend 3 months job search incentive 延长求职津贴3个月:First month 80%, Second month 5%, Third month 3%

- Extand wage subsidy program specifically for tourism sector (including retail sector) for 3 months 求职津贴延长3个月:RM600 per month for up to 500 employees

- Appreticeship program 学徒计划:RM1,000 incentive up to 3 months for participant, RM4,000 training programs claim for employer

- Jaringan PRIHATIN programme:B40 will receive RM180 telecommunication credit for by Q1 2021 (used for internet subscription or buy a new mobile phone)

- eBelia Programme: One off RM50 to e-wallet account (aged 18 to 20 years) 一次性RM50至电子钱包户口(18至20岁)

- Targeted loan repayment assistant (TRA) - Moratorium instalments for 3 months 暂还3个月 OR reduce 50% of monthly repayment for 6 months 或是为期6个月减少50%分期付款 to borrowers who are BSH recipients or BPR AND micro enterprises with loans of up to RM150K

- Simplied TRA for M40 - Just make a self-declaration of the reduction of income 自我声明收入减少

More Related Article

- For Malaysian

- Monthly salary ≤ RM 4,000.00

- Existing employers who are receiving WSP SHALL apply WSP2.0 since 1st October 2020

- Register betwwen: 1 October 2020 to 31 December 2020

- Effective period: 3 months (Existing) or 6 months (New application)

- Employers and employees must register or contribute to Perkeso before 1 September 2020 雇员及雇主需要在9月1号之前呈报Perkeso

- Registered with SSM or other local authorities before 1 September 2020 于2020年9月1号之前成立

- Shall retain employees whose monthly salary not more than RM4,000 for 6 months 6个月内不能解雇薪水不高于RM4,000的员工

- Employees who are receiving hiring incentive NOT entitled to WSP 受惠于招聘激励的员工不能申请工资补贴

- Employer no need to apply every month but will only need to update the employee's eligibility information in the system before 15th of the month (if any) 雇主不需要每个月提交新的申请,只需在该月的15号前在系统更新受惠员工资料(若有)

- If fulfil the requirements and conditions, employer can apply for those employees rejected by Perkeso before as they do not register or contribute SOCSO before 1 April 2020. The subsidy will only release for 3 months only.

- Supporting documents:

- List of employee names;

- Employer's bank account information (Copy of Bank Statement cover only);

- Business Registration Number (BRN) information registered by the employer at the time of opening the bank account;

- Copy of SSM / ROS / ROB / Professional, Scientific or Technical Services / Business License authority; and

- PSU2.0 Account Declaration

- Submit via prihatin.perkeso.gov.my since 1st October 2020

-

Company Size

1 – 75 Employees

76 – 200 Employees

>200 Employees

Subsidy

RM600 per eligible employee

Drop in Revenue

Decreasing at least 30% revenue compare with the same months in the year 2019 after implementation of RMCO

- ** The definition of Enterprise Size is based on the total number of Malaysian and non-citizen workers 雇员数量包括外籍员工

- Submit a table showing comparison between year 2019 and the same month in the year 2020